As we globally navigate the battle with Covid-19, there has been a substantial change in working conditions as more companies are performing business operations remotely. This shift is tremendously disruptive for several reasons. One (not so obvious) challenge has been adjusting the process for sending out payments via check. For most companies, distributing a physical check has been routine process from the physical office. If you are looking for an alternative, NetSuite’s Electronic Bank Payments SuiteApp could be a great solution.

The Electronic Bank Payments SuiteApp is a public bundle NetSuite offers to manage the ACH process. It is available to install as a managed bundle and includes several standard templates, including NACHA, to provide payment information to the bank. If these standard templates do not meet your requirements, you may need to procure an additional license called the Advanced Electronic Bank Payments License. This is typically needed when your bank has unique specifications for the upload, which requires customization of the template.

Electronic Bank Payments

The Electronic Bank Payments SuiteApp generates payment files to process bank payments for vendor bills, employee expenses, commissions, and refunds, and can even receive payments from customers. The bundle will generate the payment file(s) and all the pertinent information for your bank to accept or deliver payment.

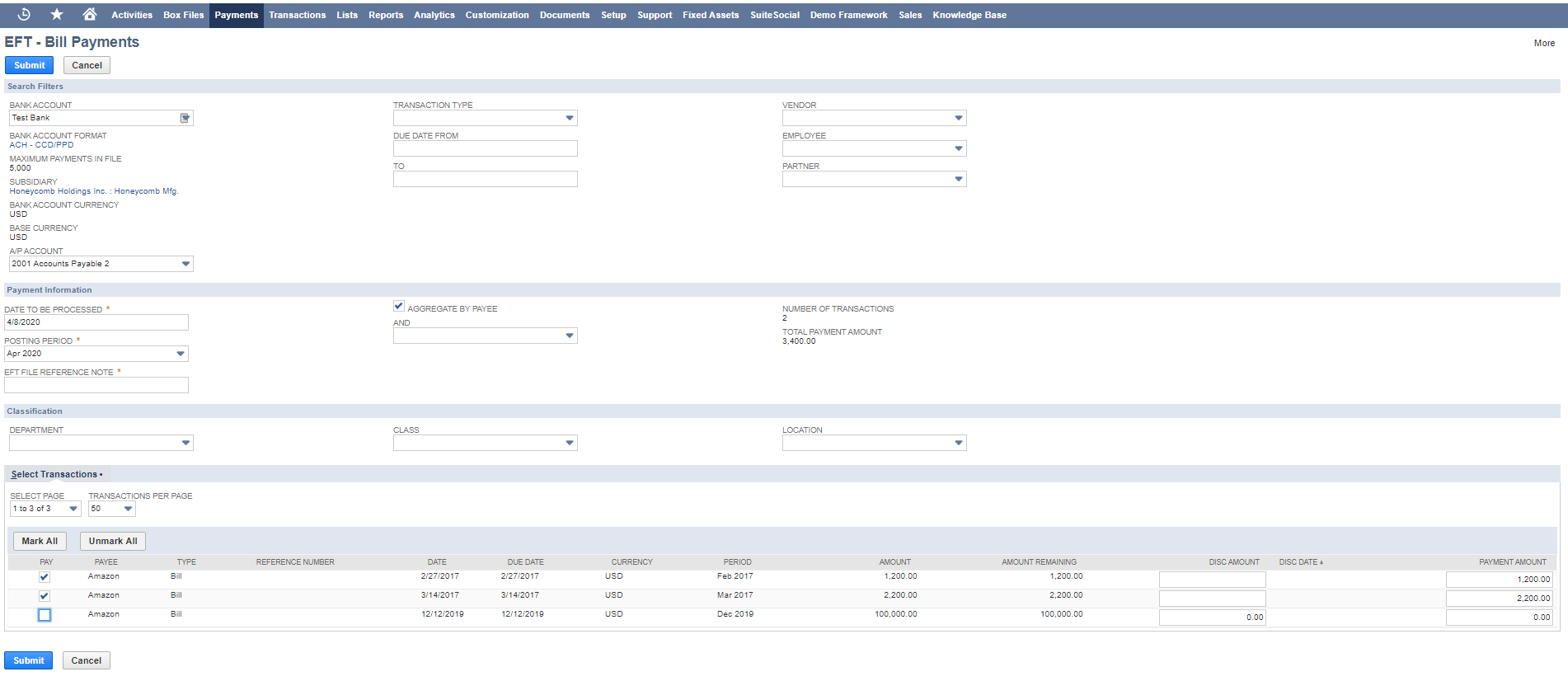

The bundle creates a new page where users will navigate to in order to kick off the ACH process. The bottom half of the page will show all the Bills that can be paid. Mark the bills to process and click submit.

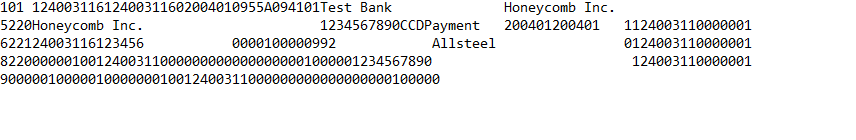

Once processed, the resulting file will be available on the “Payment File Administration” page, as well as the File Cabinet. The file can be downloaded from NetSuite and then uploaded to the Company’s bank. A customization can be designed to automate the process to the bank if desired.

An example payment file is shown below:

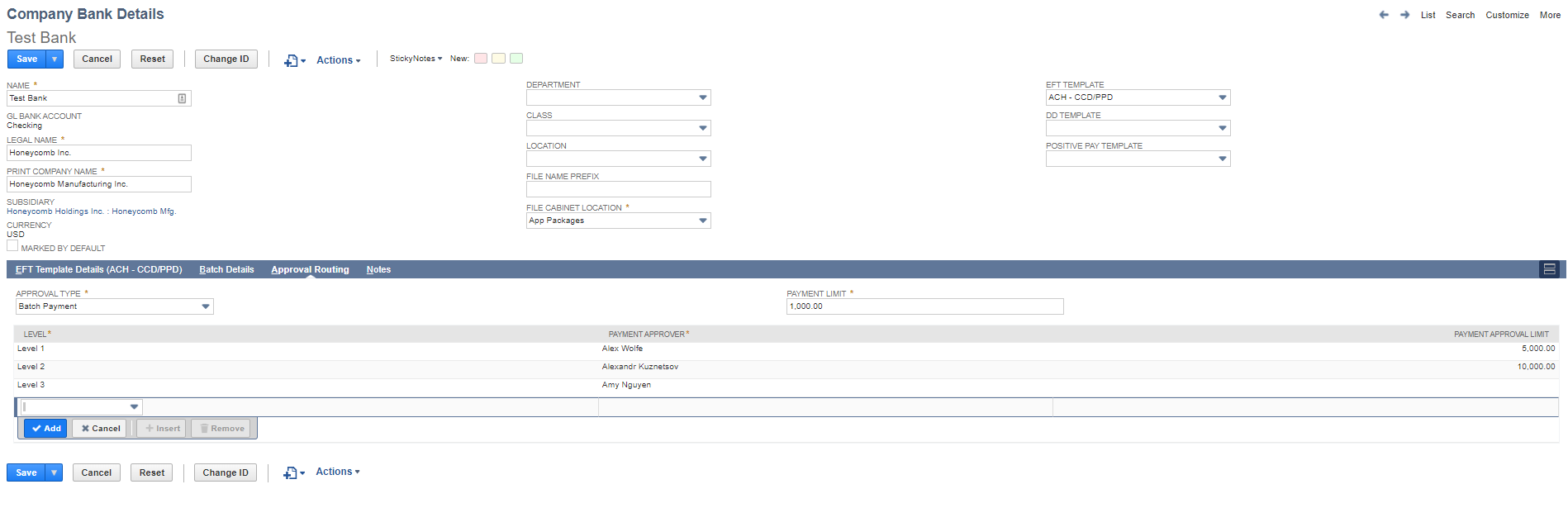

If your company requires additional controls, there is an EFT Payment Batch Approval Routing setting which directs payments through an approval process. This approval setting is configured at the Company Bank level, accommodating varying approval limits based on the bank. The final approver is configured with a blank approval limit with the understanding they are the highest and final approver. There is also a Payment Limit field which determines the maximum dollar value allowed prior to requiring approval. In this example, any batch under $1,000 would not require this approval process, while any batch over $10,000 would require Amy’s signature.

If you do not have ACH information for all your payees, you can start with just a small batch and expand usage as you acquire more payee ACH information. This is a common approach to begin rolling out the new functionality quickly. You can use the new bundle to generate ACH payments while maintaining your current check process as well.

The gains of implementing Electronic Bank Payments will benefit your firm given the “Work from Home” conditions and continue to provide cost saving and efficiency gains once we return to the physical office lifestyle. If you have any additional questions, please reach out to our consulting team at info@squareworks.com. SquareWorks has the expertise to facilitate the process and be your partner through these challenging times and beyond!