In today’s digital economy, more and more of our clients are using NetSuite’s Electronic Bank Payments SuiteApp. This allows them to process bill payments in NetSuite more quickly, as well as distribute payments to vendors more efficiently. Companies can pay employee expenses, partner and employee commissions, and customer refunds, as well as receiving bank payments from customers. By leveraging NetSuite’s Electronic Bank Payments, companies can even generate positive pay files that contain information about all checks issued from NetSuite, allowing an extra layer of financial security.

Does NetSuite’s Electronic Bank Payments SuiteApp align with your company’s objectives? In this post, we will analyze the benefits of this powerful tool, as well as walk you through basic and advanced features and how to set them up.

What You Need to Know About Electronic Bank Payments

Before moving forward with this tool, we recommend you reflect on the following questions:

- What’s my volume of payments currently? For example, will I see efficiency gains by automating this process?

- Are my payments primarily domestic or international?

- Will payments be made in foreign currencies?

- Will my bank accept the out-of-the box payment file from NetSuite, or will the file need to be customized to meet the bank’s specifications?

Overall, it’s important to weigh the benefits against the cost of any needed customizations or licenses (more on this later).

Basic Features

The most common use case for basic features is generating payment files for domestic bill payments and it is the quickest way to get up and running. In the US, only some banks will accept NetSuite’s default NACHA file out of the box.

In addition to the basic payment files, NetSuite lists the below as some of the bundle’s basic features:

- Automated creation of payment batches for approved bills

- Scheduled automatic approvals of payment batches

- Processing of multiple payment batches at the same time

- Additional payment processing capabilities such as full reversal, partial reversal, and reprocessing

- Generation of Positive Pay file formats containing details of checks issued irrespective of how they were produced

- Ability to select transactions approved for payment using different combinations of filters

If these are the only features you need, and you are only processing domestic payments, then the basic bundle is the right fit.

How to Setup the Basic Bundle

The basic bundle is straightforward to implement with only three steps.

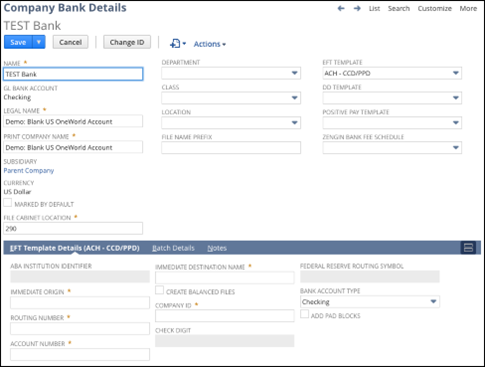

1. Set Up Company Bank Details

After installing the bundle, you’ll need to define which G/L account(s) will be used to make payments and select the correct payment template. Then associate the bank account number, routing number, and unique bank identifier assigned by your bank.

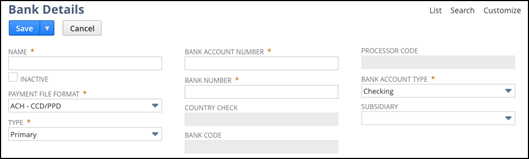

2. Set Up Vendor Bank Details

After configuring your company’s bank information, the same will need to be done for each vendor (or employee, customer, etc.) you plan to pay in this method. There will be a new subtab on the vendor (or other entity) record called Bank Payment Details, which will house the electronic banking data for this vendor. Step one is to check the EFT Bill Payment box, save the record, then click New Bank Details.

Collecting and updating vendor bank details can be time consuming and raises questions on data security. NetSuite’s permissions can be used to protect access to the data once inside the system but does not prevent mistakes that are performed manually.

Luckily, SquareWorks offers a secure vendor onboarding process that allows vendors to update their own data in NetSuite via email, so there is no need to worry about data security. If you are interested in learning more about SquareWorks’ Advanced Vendor Onboarding feature, please reach out to us here!

3. Generate Payment Files

Once the configuration is done, you’re ready to generate a payment file by navigating to Payments > Payment Processing > Bill Payment Processing. Select the company bank account and A/P accounts, then select the bills to pay.

As a best practice, we recommend sending a test file to your bank to confirm formatting. Once your bank has confirmed that the file meets their specifications, you can begin generating your payment files and submitting them to the bank for payment.

Advanced Features

The advanced features are required if you need anything more than what is listed above, which may include:

- Access to all supported standard templates

- Create and customize payment templates

- Generate instant payment files from payment transactions that uses global payment templates or custom templates

- Use of Electronic Payments APIs to build custom Bill Payment Processing Suitelet

- Support multi-currency payment processing

- Support parallel processing of payment batches for accounts with SuiteCloud Plus License

- International Wires – One of the most common requests we receive! See below for more information.

How to Setup the Advanced Bundle

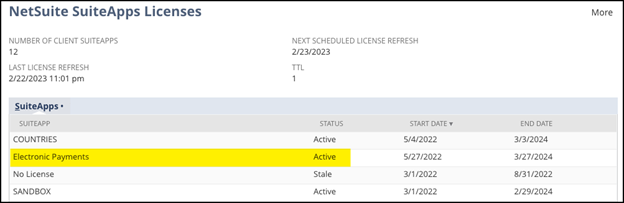

To access the advanced features requires an additional license from NetSuite, which you can track via NetSuite’s SuiteApps License bundle. This will track all active licenses you have with NetSuite.

International Wires

One of the advanced features you can unlock, which are an increasingly common request that we assist our customers with, are International Wires. These payment templates will almost certainly require customizations from a technical resource due to differing bank and country requirements. Our technical team at SquareWorks has years of experience updating these payment file templates for various banks and would be happy to assist you.

Before starting down this path, it is important to review all potential payment scenarios based on:

- Initiating bank

- Initiating and destination country

- Initiating and destination currency

- Type of payment (i.e. wire, SEPA, BACS, etc.)

Each combination of the above criteria may result in different file requirements; however, we can sometimes use the same payment file template for multiple use cases by building in conditional or logical values.

We recommend working with your bank to obtain a specification sheet that will detail their exact requirements for each type of payment. These requirements may include which data points need to be included (are intermediary bank details needed?) as well as where and how this data is displayed in the resulting payment file.

Beyond the bank’s formatting requirements, NetSuite also has some base requirements for international wires. For example, wires must be initiated from a G/L bank account denominated in the subsidiary’s base currency. The wire template also needs to be updated to specify which currencies to include in payments.

There’s an Easier Approach

Setting up custom NACHA files, building integrations with your bank, ongoing technical maintenance and preventing fraud can be a major pain-point for businesses on this path. In addition, if your business needs to quickly change banks or accounts, maintaining NACHA files and integrations can become a significant risk to your operations.

SquareWorks provides an alternative solution through our AP Automation Suite. Our Payment Automation feature allows you to optimize your accounts payable process with the most efficient and secure way to send ACH and Checks without leaving NetSuite. We go the extra mile by handling the printing and mailing of checks, alleviating you from this tedious task. With out- of-the-box support for all US banks, there’s no need to deal with NACHA files or manual integrations.

Also, your business may face challenges in collecting and maintaining bank details from vendors in an efficient and secure manner. To reduce the risk of fraud and save you time, our Payment Automation feature allows you to automatically request bank details from vendors. This enables vendors to set up their preferred payment method and supply their own bank details, eliminating the need for manual entry. Rest assured, you get to review and approve every step of the way.

For a deeper dive into SquareWorks Payment Automation feature, please reach out to us here. We’re happy to help provide you with more insights and information.