In a multi-subsidiary, multi-currency environment, it is important for any financial reporting to use appropriate exchange rates. NetSuite provides Consolidated Exchange Rates as a mechanism for proper translation of amounts between child and parent subsidiaries on consolidated reports.

You might be thinking, “we already have an integration which pulls in (Currency) Exchange Rates, why would the rates used for reporting be any different?”. Currency Exchange Rates are typically used on Transactions to translate from one currency to another (example: British Pounds to US Dollars). Consolidated Exchange Rates consider multiple layers of Translation (example: Australian Dollars to British Pounds to US Dollars).

In this first of two posts, Dan Schnock, a Senior NetSuite Functional Consultant with over 30 years of experience in system implementation, administration, and accounting, will detail the differences between Consolidated and Currency Exchange Rates and explain the different Types of Consolidated Exchange Rates. In part two, Dan will get into more details on how Consolidated Exchange Rates are set and how they are used on reporting.

Consolidated Exchange Rates vs. Currency Exchange Rates

While they may look similar, Consolidated Exchange Rates and Currency Exchange Rates are very different in how they are applied and calculated.

Currency Exchange Rates

Currency Exchange Rates are used for Translation on individual Transactions to record amounts in a currency different than the base currency of that Subsidiary. For example, if you are entering a US Dollar Vendor Bill into a Subsidiary whose Base Currency is British Pounds, NetSuite will automatically populate the USD to GBP rate in NetSuite as of the date of the Vendor Bill.

As noted in this example, Currency Exchange Rates are effective for a specific date and as such can vary from day-to-day based upon market fluctuations.

Consolidated Exchange Rates

Consolidated Exchange Rates are typically calculated based upon Currency Exchange Rates for a specific Accounting Period for each Consolidated Exchange Rate Type.

These rates are only used for reporting purposes, whether on Financial Reports or Saved Searches.

Consolidated Exchange Rate Types

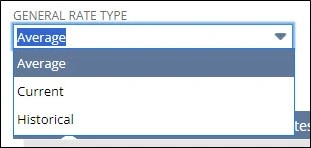

There are three types of Consolidated Exchange Rates calculated and stored in NetSuite: Average, Current and Historical. These rates work in conjunction with Account configuration to properly translate amounts for reporting purposes. A brief explanation of each Consolidated Rate type is below:

- Average – Calculated as the weighted average of the Currency Exchange Rates for all transactions posted during the period to Accounts with a Rate Type of Average. Typically used for P&L Accounts.

- Current – The Currency Exchange Rate that is effective at the end of the selected period. Typically used for Asset and Liability Accounts.

- Historical – Calculated the same as Average Rates, except for Accounts with a Rate Type of Historical. Typically used for Equity and Owner Investment Accounts.

On Accounts the General Rate Type setting should correspond to the Consolidated Rate Type to use for calculating amounts on reports.

Accounts also have a setting for Cash Flow Rate Type, which defines the Consolidated Rate Type to be used specifically for the Statement of Cash Flows. The options available are the same as the General Rate Type and will typically be the same Rate Type selected.

It is important to note that you are unable to select which Transactions are used in calculating the Average and Historical Consolidated Rates for an Accounting Period, they are automatically calculated using all the Transactions posted for these account types during the Period. As such, these rates can be skewed by when Transactions are posted. For instance, if you post a large volume of Transactions at the end of the period, the Average rates will skew more towards the month-end rates.

Conclusion

To generate accurate Financial and Transaction Reporting in an environment with multiple Subsidiaries and Currencies, NetSuite defines Consolidated Exchange Rates. These rates are typically calculated by NetSuite based upon Currency Exchange Rates imported into NetSuite or included on individual Transactions. You can configure each Account to use a specific Consolidated Rate, but you cannot define how the rates are calculated. If your team would like to incorporate Consolidated Exchange Rates in your reporting and need assistance, please reach out to us here.

Stay tuned for part two where we dive into how Consolidated Exchange Rates are set and how they are used on reporting.